Get ready for minimum wage hike

The National Living Wage (NLW) for workers aged 23 and over will go up by almost 10 per cent in April. Are you ready for the increase?

The rate will rise to £10.42. That represents an annual pay increase of more than £1,600 for a full-time worker.

The 92p rise, announced by the chancellor in his autumn statement is also the largest ever cash increase to the NLW.

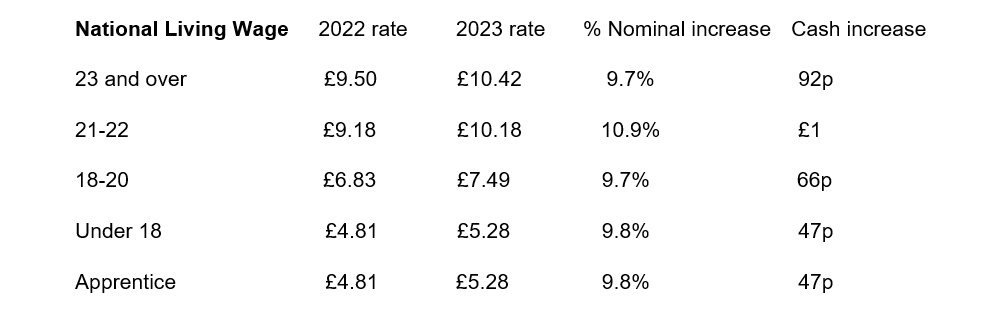

Changes to the other National Minimum Wage (NMW) rates including percentage rises, can be found here:

HMRC stresses that paying the National Minimum Wage can be more complex than just paying your workers the correct rate. These are just a few of the risks and common causes of underpayment they are keen to highlight:

• Deductions and payments for items or expenses that are connected with the job.

• Unpaid working time for example, team handovers between shifts or time spent passing through security checks on entry and exit.

• Incorrect use of apprenticeship rates. For example, paying the minimum wage apprentice rate when the worker is not a genuine apprentice, or paying the minimum wage apprentice rate before a worker starts their apprenticeship, or after it ends.

To discuss any issues raised in this article please contact me on 01772 430000