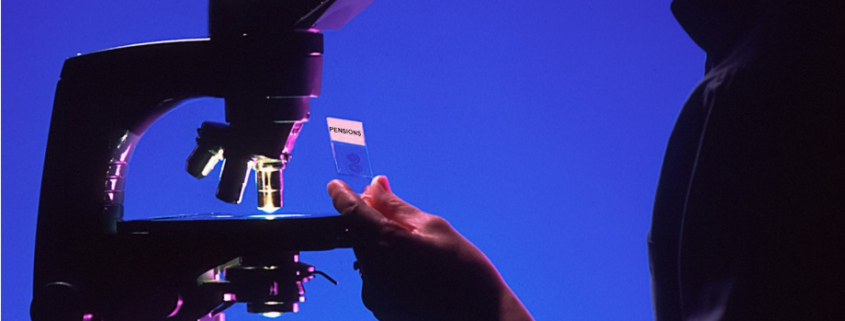

Commission to act on ‘retirement crisis’

The government has revived the landmark Pensions Commission to confront what it has labelled a ‘retirement crisis’.

It says that without action tomorrow’s retirees are on track to be poorer than today’s.

Almost half of working-age adults are still saving nothing with low earners, some ethnic minorities and the self-employed least likely to be pension saving.

The revived Pension Commission will consider the long-term future of the pensions system.

The Commission of 2006 was declared a huge success at the time, building a consensus for the roll-out of Automatic Enrolment into pension saving that means 88 per cent of eligible employees are now saving, up from 55 per cent in 2012.

However, new analysis shows that there is more to do with the incomes of retirees set to fall over the next few decades if nothing changes:

The government says retirees in 2050 are on course for £800 or eight per cent less private pension income than those retiring today.

And it points to the fact that four-in-ten or nearly 15 million people are under saving for retirement.

This partly reflects too many working age adults (45 per cent) saving nothing at all into a pension, with lower earners, the self-employed and some ethnic minorities particularly at risk.

More than three million self-employed people are not saving into a pension.

The new analysis also reveals a 48 per cent gender pensions gap in private pension wealth between women and men.

A typical woman currently approaching retirement can expect a private pension income worth over £5,000 less than that of a typical man.

While the introduction of Automatic Enrolment increased the numbers saving, saving levels have often remained low. Around one-in-two workers in the private sector only save around the minimum contribution level.

The relaunched commission will explore the complex barriers stopping people from saving enough for retirement, with its final report due in 2027.

The government says: “It will examine the pension system as a whole and look at what is required to build a future-proof system that is strong, fair and sustainable.”

Work and Pensions Secretary Liz Kendall says: “People deserve to know that they will have a decent income in retirement – with all the security, dignity and freedom that brings. But the truth is, that is not the reality facing many people, especially if you’re low paid, or self-employed.

“The Pensions Commission laid the groundwork, and now, two decades later, we are reviving it to tackle the barriers that stop too many saving in the first place.”

• To discuss any issues raised by this article please contact me on 01772 430000